Investor Relations

Wishpond is a profitable and rapidly growing marketing technology company. Wishpond’s mission is to empower entrepreneurs and businesses to achieve success online through the use of innovative and cost-effective digital marketing solutions.

Download Investor DeckWhy Invest in Wishpond?

TSXV:WISH

OTCQX:WPNDF

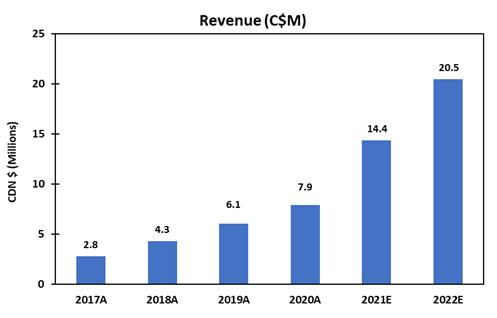

Fast Growing & Profitable

~30% compound annual growth for the past three years and EBITDA positive since fiscal 2019.Technology Enabled

Proprietary technology providing advanced and intuitive marketing tools capitalizing on key industry trends.Lean Structure

Lean structure allowing Wishpond to provide scalable marketing services at rates difficult to replicate by traditional marketing agencies.Scalable

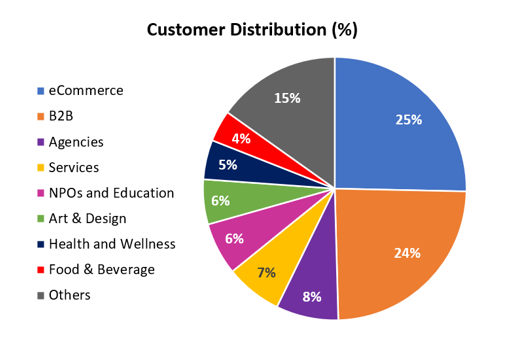

Proven scalable sales engine delivering strong revenue visibility.Diversified Customer Base

~3,000 paying customers with little economic dependence on major accounts.Strong Management

Experienced management team with long tenure and proven track record in the marketing-software industry.One-Stop-Shop

Wishpond offers several marketing tools integrated into a single platform, providing a cohesive customer experience for the price of a single subscription.Significant Growth Ahead

Significant opportunities for continued growth including product and service expansion, geographic growth, and strategic acquisitions.Predictable and Scalable Sales Engine

Proven sales engine delivers strong revenue visibility with a predictable LTV to CAC ratio of 3.51 to 1.Key Differentiators

Wishpond’s primary differentiators over the competing platforms include:

Cohesive Platform

All Wishpond tools work seamlessly together with no need for any additional integration. In many cases, the functionality of Wishpond’s tools is superior than competing platforms specializing on a single vertical.

Service Component

While companies may be able to access competitors’ tools, very few companies offer the service of managing customer’s accounts to help them achieve success with them. Those who do are generally unable to offer rates that a traditional SMBs can afford.

Cost Efficient

For the cost of a single subscription, Wishpond’s customers get access to all the different tools which they would otherwise have to purchase individually from specialized providers.

Financial Profile

Wishpond is cash-flow positive and expected to grow at over 70% in 2021. Wishpond has a subscription-based recurring revenue model that provides excellent revenue and cash flow visibility.

2020, 2021, 2022 estimates based on Beacon Securities, Eight Capital, and Paradigm Capital analyst projections

Wishpond (TSXV: WISH, OTCQX: WPNDF)

Analyst Information

| Company | Name | Location | Phone Number | |

|---|---|---|---|---|

| Beacon Securities | Gabriel Leung | gleung@beaconsecurities.ca | Toronto | (416) 507-3964 |

| Paradigm Capital | Daniel Rosenberg | drosenberg@paradigmcap.com | Toronto | (416) 553-2521 |

| Eight Capital | Christian Sgro | csgro@viiicapital.com | Toronto | (647) 253-1133 |

Latest News & Press Releases

April 24, 2025

If you have any questions about investor relations, reach out to us at any time at investor@wishpond.com